epf employer contribution rate 2019

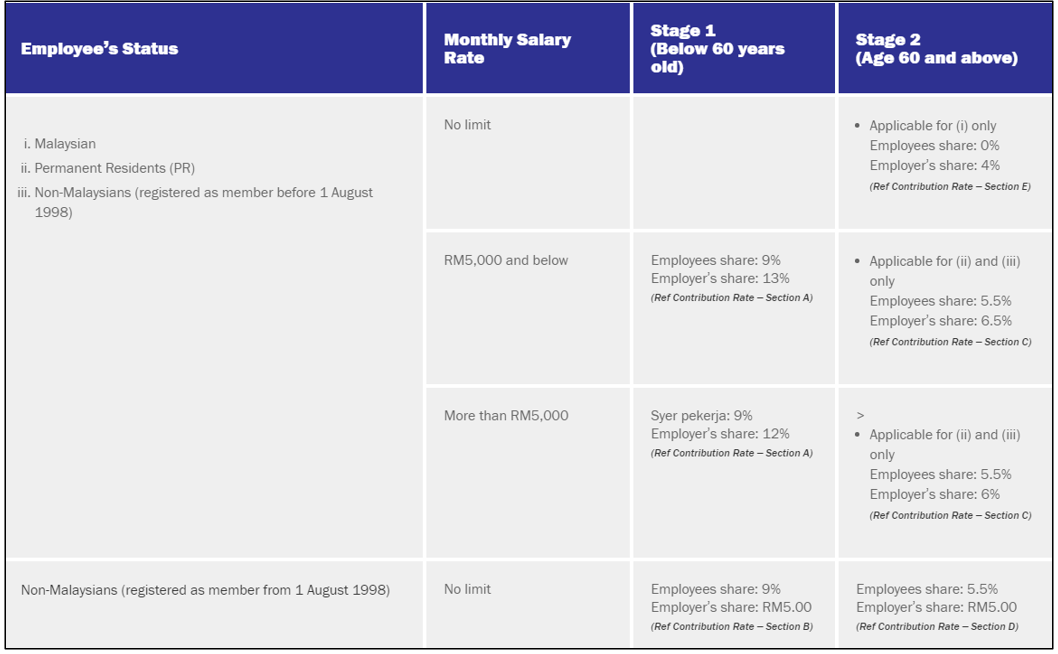

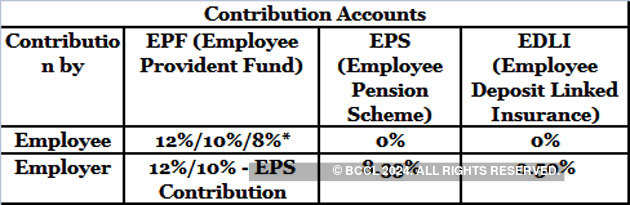

6 Ref Contribution Rate Section C Non-Malaysians registered as member from 1 August 1998. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

Defining The Benefits Db Vs Dc Plans

Union Budget 2021 Outcome In case the employees PF contribution was deducted but not deposited by the employer it will not be allowed as a deduction for the employer.

. Employer Contribution is divided as. Theyll detect when receiving the EPF statutory contribution from the employer under statutory contribution and thus no longer on i-Saraan. Can an employee opt out from the Schemes under EPF Act.

Yes- they will apply 12 of my basic pay for both employee and employer contribution my basic pay is 40000 initially when i joined 3 years ago i have opted PF option as YES so now they are deducting straight 12 of my basic which is 4800 as employee contribution and another 4800 as employer contribution. The total contribution by the employer and employee towards the EPF account of the employee Rs 1680 Rs 514 Rs 2194. Foreign workers are protected under SOCSO as well since January 2019.

1 Pre - Qualification bid opening on 11062019 at 1200 Noon 2 Technical bid opening on 12062019 at 0300 PM 3 Financial bid opening on 19062019 at 1100 PM. Employees Provident Fund EPF 367. So this 9600 makes my take home lesser.

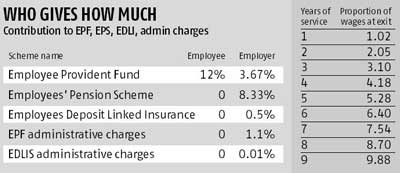

The EDLIS the EPF admin charges and the EDLIS admin charges. EPF Contribution by Employee and Employer. You can also check the past changes in historical EPF interest rates.

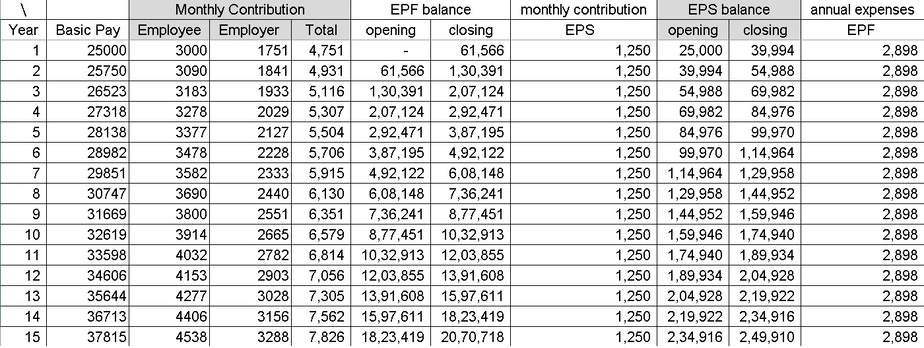

December 12 2021 at. The following table shows the monthly contribution. Employees contribution to the EPF account is eligible for deduction under Section 80C.

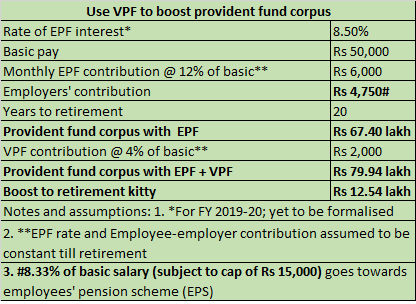

Employer contribution to EPF. For the FY 2019-20 the interest rate notified is 85. The interest earned on the EPF Account balance every year is tax-free.

As mentioned earlier interest on EPF is calculated monthly. Assuming the employee joined the Firm XYZ in April 2019. But the employers contribution is allocated across the EPF and the EPS.

As of now the EPF interest rate is 850 FY 2019-20. The employer also bears 3 additional costs ie. Tax Rate Upto 250000 Nil From Rs250001 to Rs500.

EPF vs PPF Interest Rate 2019. EPF Interest Rate - Interest rate of EPF is reviewed every year after consultation with the Ministry of Finance by EPFOs Central Board of Trustees. The Employer has to provide Apprentice the Training in his Trade ensure that the Person duly Qualified is placeed as In-charge.

235 thoughts on Can My New Employer Check My Previous EPF Deductions. Gross Salary Cost to Company CTC - Employers PF Contribution EPF - Gratuity Gratuity calculation. Payment to Apprentice - The Minimum Rates of Stipend prescribed under the Rules as follows.

The total EPF contribution for April will be Rs 2194. Employers contribution is also tax free but it is not eligible for deduction under Section 80C. According to a Bengaluru bench of the Income-Tax Appellate Tribunal ITAT ruling the interest credited to an Employees Provident Fund EPF account after an individual ceases to be in employment is taxable in his hands in the year of.

The interest rate for the scheme has been revised and lowered by 015 for the. 15000 from existing Rs. Breakup of Contribution if Salary is above Rs.

Depending on the entity contributing towards EPF there are two components. Monetary payments that are subject to SOCSO contribution are. Employers EPF contribution rate.

The Union Labour Minister Santosh Gangwar announced the new interest rates for EPF on 3rd March 2020. 4 Employees Provident Fund EPF. On 30 August 2022 EPFO proposed to remove the restrictions on the wage ceiling and headcount to allow all formal workers and self-employed to enrol in its retirement.

The notification effective from September 1 2014 disallows the EPF scheme member from joining the pension scheme if monthly pay exceeds Rs15000 at the time of joining If the individual is not eligible to open an EPS account then the employers entire contribution will go to the EPF account. Employee Pension Scheme EPS 833. Hike in EPF Interest Rates 2018-19.

The entire 12 of your contribution goes into your EPF account along with 367 out of 12 from your employer while the balance 833 from your employers side is diverted to your EPS Employees Pension Scheme and the balance goes into your EPF account. The EPF interest rate for FY 2018-2019 is 865. If we give UAN id and member id to new employer then he can see PF contribution amount and amount available in PF account.

So the interest rate applicable for each month is. Contribution by an employee Contribution towards EPF is deducted from the employees salary. Contribution by an employer -The contribution made by the employer is 12 of the basic salary of the employee.

Vide notification dated 22082014 Ministry of Labour and Employment has increased Employee Provident Fund EPF Limit to Rs. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. And the best part is that the money that you.

Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. EPF interest rate is tax free. Employees EPF contribution rate.

RFP for selection of Portfolio Managers. Revised EPF Interest Rate for 2019-20. The employer must pay their employees contributions on or before the 15th of the following wage month.

As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M. With the EPF contribution rate of between 7 to 11 employee and 12 or 13.

The contributions made by employer and employee towards the EPF account is the same. The interest rate is 81 for FY 2022-23. Effective from 1 January 2019 to March 2020 January 2019 salarywage up to March 2020.

However during the period when contributions dont get credited to the PF account the interest rate earned does not remain tax-free. However this 12 is further subdivided into. Your employers contribution to your EPF is also tax-free.

MINISTRY OF LABOUR AND EMPLOYMENT NOTIFICATION New Delhi the 22nd August 2014. In 2019 Govt has proposed to levy surcharge of 25 on those having taxable income of more than Rs 2 Cr upto 5 Cr. 12 of the employees salary goes towards the EPF.

To Carry out all Legal Contractual Obligations. In March 2022 the EPFO lowered the interest rate on employee provident funds to 810 for 2021-22The EPFO lowered the interest rate of 810 for the fiscal year of 2021-22. Revised EPF Interest Rate for 2019-20.

EPF Limit increased to Rs. Payment of 85 interest to around 6 crore EPF subscribers with the onset of the year 2021. However it becomes taxable when you leave service at an EPF registered.

Malaysian age 60 and above. Lets use this latest EPF rate for our example. 15 of income tax where total income exceeds Rs.

The FY 2021-22 EPF interest rates are as per the date March 12 2022 EPF Contribution Rate FY 2021-22. Key Points about EPF Contribution. 12 Employers contribution includes 367 EPF and 833 EPS.

But this rate is revised every year. 085 for EPF Administrative Charges. Breakup of EPF Contribution.

Do Companies Actually Add 12 Into An Employee S Pf Account From Their Account Or Do They Just Adjust The Amount From The Employee S Salary Itself Quora

Epf New Employee Minimum Statutory Contribution Rate On Ya2021 Yau Co

Download Employee Provident Fund Calculator Excel Template Exceldatapro

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Epf A C Interest Calculation Components Example

Ss Perfect Management Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Bi Jadual Ketiga 2020 Kwsp Pdf Facebook

Epf A C Interest Calculation Components Example

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

How Epf Employees Provident Fund Interest Is Calculated

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Everything You Need To Know About Running Payroll In Malaysia

Statutory Compliance In India Pf Esi Pt Lwf Zoho Payroll

All Employee Provident Fund Questions Answered

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

St Partners Plt Chartered Accountants Malaysia Monthly Contribution Rate Third Schedule The Latest Contribution Rate For Employees And Employers Effective April 2020 Salary Wage Can Be Referred In The Third Schedule

Reduction In Epf Contribution Opt For Vpf To Make Up For The Decline In Your Kitty

Epf Interest Rate From 1952 And Epfo

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

Comments

Post a Comment